This engaging intercultural journal offers descriptive and analytical articles. Asian Theatre Journal is dedicated to the performing arts of Asia focusing upon both traditional and modern theatrical forms.

21 Offenses Penalties And Appeals In Gst How To Safeguard Yourself

Here candidates can enter basic details location details preferences associated programes and interested in fields.

. 600 till September 10 2022. How to Check GST Registration Application Status. If the vendor and purchaser are related firms and the value for duty is the transaction value of similar goods code 26 is shown.

Appeal To Appellate Authority. It is devoted to the study of phenomena that transcend the boundaries of single states regions or cultures such as large-scale population movements long-distance trade cross-cultural. If a used goods rate of duty advance is applicable code 1 must be prefixed to the value for duty code.

Hence GST would be payable on. 05-03 Luzerne Singapore 339940 Luzerne is formerly known as. It aims to facilitate the exchange of knowledge throughout the international theatrical community for the mutual benefit of all interested scholars and artists.

43 What are the course contents of the. FORM GST APL-01. 262019 CTRate and the same reads as under.

Welcome to the United Nations. GST-registered businesses are required to charge and account for GST at 7 on all sales of goods and services in Singapore unless the sale can be zero-rated or exempted under the GST. The training will be conducted over one full day 7 hours and will costS33000 per person after GST.

311Submission of the bid should be from users of gas existing as well as new industries including reseller of gas. Complete if a SIMA amount is shown in Field 33. Last updated on 03 November 2021.

Commissioner hereby extends the time limit for making a declaration in FORM GST ITC-01 by the registered persons who have become eligible during the months of July 2017 August 2017 and September 2017 till the 31st day of October 2017. Application To The Appellate Authority Under Sub-Section 2 Of Section 107. I The term bus body building has been defined as building of body on chassis of any vehicle falling under chapter 87 by virtue of Explanation which was inserte Notification No.

ESPro before submission can take place. There is no Sectoral Priority and bids from all existing as well as new industries will be treated at par. From the time of submission of GST registration application the status can be checked on the GST portal.

If the used goods advance applies code 126 is shown. Summary Of The Demand After Issue Of Order By The Appellate Authority Tribunal Or Court. 312The Bidder if successful shall submit an undertaking as per format placed at Appendix 8A prior to.

Moreover candidates must take a printout of the completed PMKVY online application form for any. After submitting all the necessary details candidates can click at the Submit button to complete the registration process. The power to detain is only to stop the transit of the goods and thereby prevent its movement till the tax and penalty is paid.

In terms of Section 341 of the CGST Act 2017 in case of return of goods on which GST was paid at the time of supply the supplier of such goods may issue a credit note for the full value including the amount of GST in favour of the recipient and will be entitled to reduce his output tax liability subject to the condition that the recipient of such supply has not availed credit of such. General Knowledge of Gujarati is essential. When to file form RFD-01 RFD-01A for tax refund in case of exports The excess of unutilised ITC Input Tax Credit can be claimed by way of filing Form GST RFD-01 for online filing GST RFD-01A for manual filing.

On-line submission of application commences 25th August 2021 Last date for On-line submission of application 14th September 2021 Important Dates The last date of On-line application is 14th September 2021 0600 pm. 26 SIMA Code. On successful submission a unique IRN number will be generated which can be used for future reference.

Corenet eSubmission for Professional ESPro is only applicable for project members. If you have applied for GST registration it normally takes about 7 working days for the provisional GSTIN to be allotted and 10 days to obtain the final GSTIN with GST registration certificate. Seeks to extend the time limit for submission of FORM GST ITC-01.

Final Deadline to Claim Payouts for Expired Cheques Issued Under 2020 Government Cash Grant and 2021 Rental Support. CA Final Exam Form 2022 - The exam form of CA Final 2022 for November session open till September 7 2022 without late fees and with late fees of Rs. Jurisdiction - Power to confiscate goods - The power to detain under Section 129 cannot be converted to a proceeding under Section 130 of the Act since both these provisions operate independently of each other and in completely different contexts.

The Government of Tamil Nadu is in the process of creation of new eProcurement portal for carrying out all procurement related activities online by all Government. Acknowledgment For Submission Of Appeal. Explanation For the purposes of this entry the term bus body building shall include building of body on chassis of any vehicle falling under.

AAR held that club of membership association and its members are distinct persons and the membership subscription fee and annual fee received from its members are consideration for supply of goodsservices as a separate entity covered by the scope of the term business and thus principle of mutuality is not applicable. The Journal of World History publishes research into historical questions requiring the investigation of evidence on a global comparative cross-cultural or transnational scale. Candidates can check the detailed information on CA Final 2022 exam form how to fill major exam form dates fees correction form and related faqs.

Sbi Card Plans The Perfect Weekend For You Apply For Your Sbi Card Online And Unlock These Offers To Apply Visit Https Www How To Apply How To Plan Cards

Due Dates Of Gst Payment With Penalty Charges On Late Payment

Rs 20000 Penalty For Gst Of Rs 15 Https Taxguru In Goods And Service Tax Rs 20000 Penalty Failure Issue Invo Goods And Service Tax Indirect Tax State Tax

Gst Late Fees Late Fees And Interest On Gst Returns Quickbooks

How To File Clarification In Gst Application Raised By The Department Step By Step Youtube

Submit Reply Of Pending For Clarification In Gst Registration Process Gst Registration Status Youtube

Gst Late Fees Late Fees And Interest On Gst Returns Quickbooks

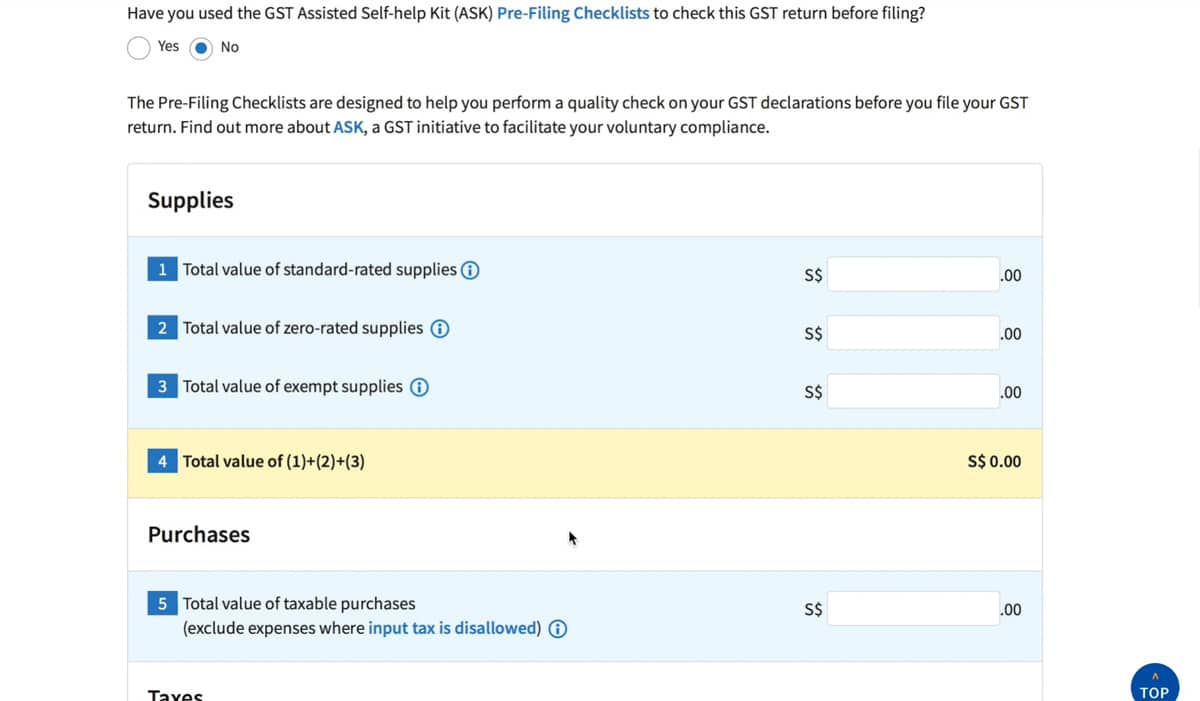

A Basic Guide To Gst F5 Form Submission To Iras Paul Wan Co

Types Of Gst Returns Filing Due Dates Of Returns Quickbooks

Gst Filing Process How To E File Your Gst Return In Gst F5 Sg Small Business Center

Appointment Of Ca Firms With Pspcl For Ind As Implementation Http Taxguru In Finance Appointment Of Ca Firms With Pspcl Finance Corporate Law Appointments

Gst Registration Cancellation Live How To Cancel Gst Registration Gst Number Cancel Surrender Youtube

Cbic Cannot Cheat Assessee By Manipulative Interpretation Part Ii Interpretation Cheating Denial

Jee Main Aopplication Form 2020 Application Form Aadhar Card Application